Aggregate Demand & Supply

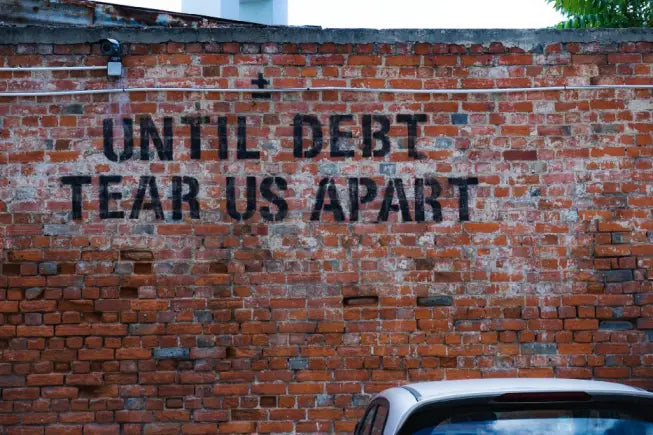

The Great Recession occurred between 2007 and 2009, which began before 2007 due to long standing economic policies and decision making, but most notably, the recession’s beginning struck in 2006 when home values crashed by 30%. This massive shift in value began a spiral of in value of mortgage-backed securities impacting homeowners and institutions. From an economic standpoint, the Great Recession is characterized by a drop in aggregate demand which translated into a decline in GDP, which increased unemployment. In order to understand the Great Recession, one needs to understand how the economics of poor policy making led to this event.

The Aggregate Demand (AD) Curve is defined as the “the total quantity of all goods (and services) demanded by the economy at different price levels” (Ball, 1995). The AD curve represents the demand and supply for an entire economy rather than just a single market, good or service (Ball, 1995). The Aggregate Demand (AD) Curve is defined as the “the total quantity of all goods (and services) demanded by the economy at different price levels.” The AD curve represents the demand and supply for an entire economy rather than just a single market, good or service (Ball, 1995). Understanding these definitions provides the basis for understanding the Great Recession in terms of the real-estate bubble that ultimately collapsed the real estate market and lending markets.

Prior to 2007, lax lending rules began increasing homebuying for more than a decade prior. Easier-to-acquire home loans largely increased aggregate demand which fueled more home-selling, purchasing, and building thus fueling the lending the industry. As aggregate demand increased prices the competition for this market focused on lending terms as a means to acquire customers using adjustable-rate mortgages and subprime loans. By 2007, the demand began decreasing but these adjustable mortgages and subprime loans now became unaffordable to many people since their incomes had not increased to match the higher interest rates. As this began occurring nationally, the sudden aggregate supply increased as the supply of homes shocked the system and dropped home values tremendously. This can be seen in the number of foreclosures that began occurring which in turn collapsed the lending industry and unemployment began rising.

In 2007, aggregate demand began falling as aggregate supply increased and by 2008, GDP fell at an annualized rate of approximately 8.9% (Duhigg, 2008). What can be seen in this situation is adverse aggregate supply shocks can occur when competition is unregulated (Ball, 1995).

These economic factors show the importance of regulating financial industries and scrutinizing lending practices to not create unsustainable economic policies based on ever increasing purchasing.

References

Ball, Laurence and Mankiw, N. Gregory. “Relative-Price Changes as Aggregate Supply Shocks”. The Quarterly Journal of Economics (1995) 110 (1): 161–193.

Duhigg, Charles. (2008). Pressured to Take More Risk, Fannie Reached Tipping Point Retrieved from https://www.nytimes.com/2008/10/05/business/05fannie.html

Photo by Ehud Neuhaus on Unsplash

~Citation~

Triola Vincent. Sat, Jun 05, 2021. Economics The Economics of the Great Recession Retrieved from https://vincenttriola.com/blogs/ten-years-of-academic-writing/economics-the-economics-of-the-great-recession